Reviving Challenged Assets.

Realizing Latent Potential.

Velde Equity

Velde Equity is an operator-led special situations investment firm that partners with corporate, financial, and founding sponsors, as well as lenders, to revive challenged assets and elevate businesses with latent potential. We bring flexible capital solutions, embedded turnaround and transformation leadership, and a positive-sum philosophy to drive enduring performance and outsized returns.

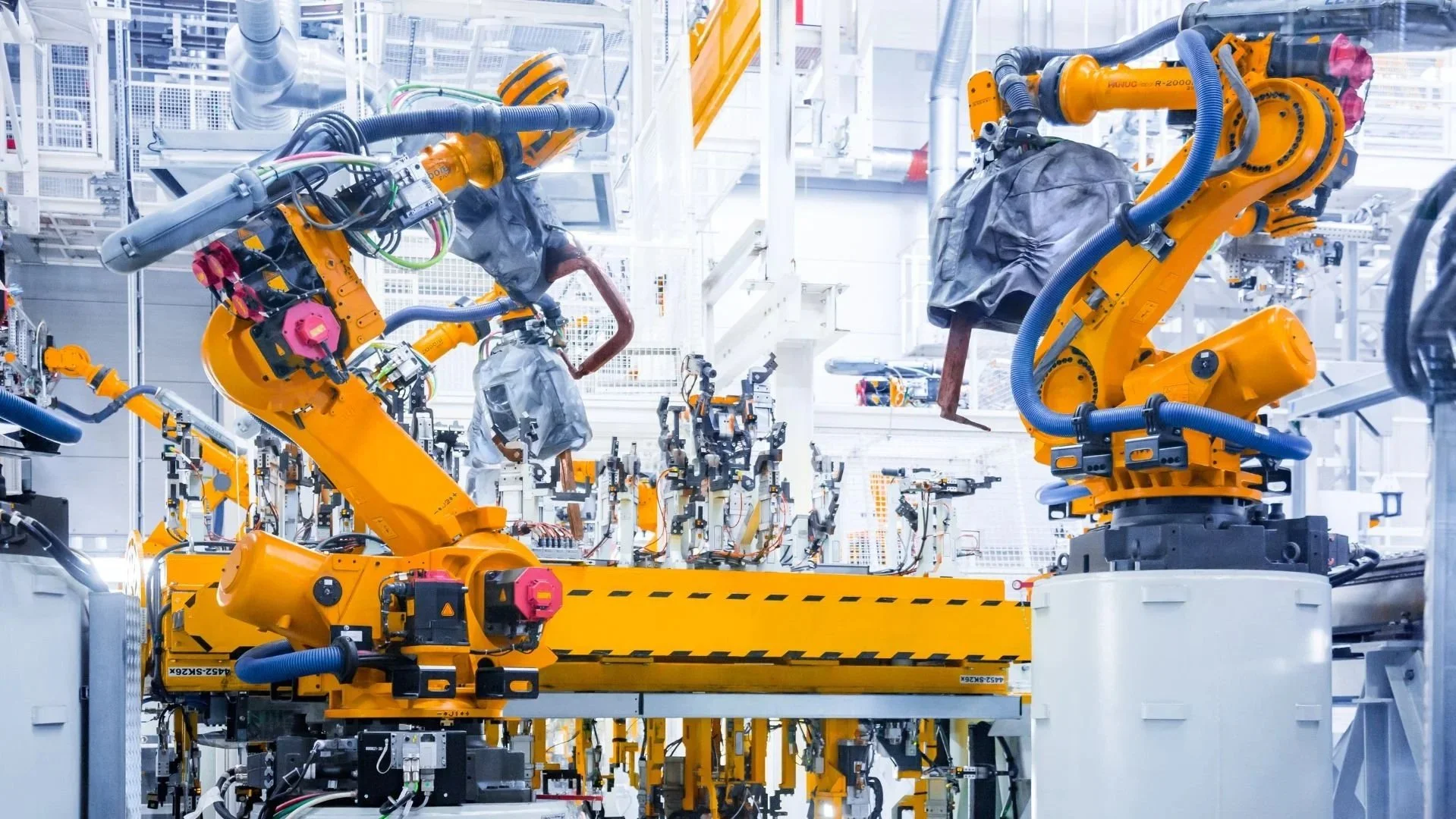

Operator-Led Capital for Special Situations

Operator-led capital solution for lender workouts and legacy fund assets

We act as a constructive 'workout group' for private credit and private equity. We step in with fresh capital and hands-on operational leadership, protecting principal and valuation marks where internal bandwidth or mandates are constrained.

Operator-led underwriting for operationally challenged businesses and complex mandates

When "hair on the deal" stalls a process, we provide certainty. We utilize adaptive capital solutions to underwrite the future operational fix rather than past performance, turning stuck mandates into closed transactions.

Operator-led stabilization and transformation for sub-scale divisions and corporate orphans

We acquire sub-scale, non-core assets that drain resources from corporate sponsors. Our model allows corporate parents to divest the distraction while retaining the strategic optionality of a revitalized independent platform.

Why Partner with Velde

-

Built on a foundation of C-level transformation leadership, private equity operations, and McKinsey’s RTS methodologies, we combine deep M&A expertise with disciplined execution. We turn latent potential into durable performance—specifically in complex situations where previous efforts have stalled.

-

Whether the situation requires liquidity, de-risking, or separation, we tailor capital around the objectives at hand—not a preset mandate.

We have the flexibility to assume control of assets or co-invest and provide embedded operational leadership. -

We operate beyond zero-sum thinking, serving instead as a platform for positive-sum partnerships and shared value creation.